|

Running your business is very challenging job. Every day you will face new challenges and your to-do-list will never end. But even the busiest routine is not an excuse when it comes to having online visibility. Small business owners think that they don’t need a website. They think only big business giants need or can afford to have a website. This argument is wrong. Here are 3 reasons for small business to have website.

1- First Impression is The Most Important: Today’s world where we live is ever changing. Before people decide to buy something, they do some digging about the product and seller or supplier. They do it for many different reasons. The first thing they will probably look for is your website. Later they will dig for people’s review about your business. They will search for you on social media and popular business directories. Because of this your first impression has to be the best. People will make decisions on the basis of the look and feel of your website. If your website does not reflect the kind of experience you business should offer, they likely to reject you entirely. So, if your website is offering rich user experience, people will likely to visit your outlet, office, restaurant or store. 2- Evolution in Window Shopping: The time of traditional way of window shopping is long gone. Strolling down your local main street is not the only way people check your business or product. For window shopping, people now visit websites, social media sites, business directories etc. to plan their next purchase. First of all you need to have a website. Secondly, you need to have business pages on all popular and relevant social media sites. Link your social media pages with you website. Submit your business to all famous business listing sites to enhance your business’s online visibility. Make sure your street address, phone number and other contact information is easy to find and easily visible on your website. You also need to be active on your social media channels and these links also is there on your website. 3- Say No To Website and Loose Business: In today’s world having no website means you are losing business. Say you are selling cars but you don’t have a website. The person willing to buy a car will do some research on search engines. You don’t have a website so you are nowhere to be found. That person will visit your competitor’s website and will make a purchase from him. So, you must have a website and it must be a good one. Having a bad website is even worse than having no website at all. A bad website will make your business look bad. Therefore a bad website or no website at all, both are bad for business. Closing Remarks: We are sure, by now you as a small business owner understand the importance of having a website for your business. Next step is increasing your website’s visibility on search engines so that people can find you online. But that is the topic for another article. Keep visiting RE2QA official blog for reading more informative stuff. Source: This article was originally published at official blog of RE2QA by the same name "3 Reasons For Small Business To Have Website". RE2QA is a USA based IT firm famous for providing web development services around the world.

0 Comments

If you think that designing and developing an iPhone application is a cheaper thing, you are far beyond reality. The amount any development company may charge will be surprising and in-house development cost you even more. One reason is the Apple’s platform which is expensive and the second reason is the limited availability of real professionals capable of making a difference to your application idea. Does this mean only companies with huge investment can go for iOS development project? Of course not, in this article we will give you tips to keep the iPhone application development cost under control.

Stick To the Idea and Requirements The biggest reason of cost increase is when you divert from the original idea. Most of the time companies shoot the development process in a hurry and then during the development process they realize that there should be more features to be developed in the application. More features mean more investment. So the key to success is to stick to the idea and requirements. Before deployment of developers, you need to be 100% certain of what you need. You must have all possible details with the draft of the idea. These requirements are made with extensive research about the audience, expectations, competition, demographics and various other factors. Once you have crystal clear requirements well documented, employ developers for building the application. Keep in mind, never ask developers to make any change which is not the core part of the project as this will give him the reason to charge extra. Whereas when they have a well written document, they know what they have to develop and they will not be able to charge high. This will also keep them stick to the deadline. MVP Approach It is always difficult to decide which features and functionalities should be added in the initial version of an application and which must be added in the subsequent updates. To deal with this chaotic situation, we suggest you go with the MVP approach. The Minimum Viable Product Development or MVP is the approach in which a new application is developed with features sufficient enough to satisfy the needs of early users. With the passage of time you can add additional functionalities to the subsequent updates. This will reduce significant cost of the department. Skills Vs Cost Comparing cost with skill will prevent you from paying extra. If you are new to mobile application development, this comparison will help you to single out the most reasonable service provider. Keep one thing in mind, never compromise on quality. Always choose a company like RE2QA which has a mobile application portfolio to be sure that your idea and product is in good hands. Native Vs Open Source Approach There are various open source platforms available and using them for application development can reduce development cost. You only have to develop one app and it will be available for both iOS and Android. But this will allow you limited customization options. In native approach you go according to the book and guidelines of Apple and Google which allow you full control. The decision is yours. We will suggest going with the quality. Outsource Properly If you are going to outsource your project, make sure you do it properly. It’s better to work on a fixed project price. This way you only have to pay a pre-fixed amount and you do not have to pay anything extra if project get delayed for few days or week. If you prefer hourly basis payment, make sure that you have a clear plan in hand and you know exactly how much time requires to develop a particular feature or functionality. Source: This content is taken from the official blog of RE2QA which is software company well known for mobile application development services. Life can get hectic, especially if you live in a bustling urban center, so we should treat ourselves every now and then with a beneficial and relaxing activity. A singular day at the spa in a span of two months can do wonders for your physical and mental health. However, such outings can be quite expensive, not to mention time-consuming. Therefore, so many people choose to create conditions for a pampering spa treatment in their own home. If you have enough funds for such a project and you think you can benefit from it, here are the basics of creating the perfect spa bathroom. Begin with the broad strokes Interior designers are introducing greenery as the next prevalent trend in the bathing areas, and this is an amazing trend to follow if you want to create a spa bathroom. However, this only works if your space has an influx of natural light, which is also something that is not a guarantee if you live in big cities. Still, incorporating eye-catching houseplants into your bathroom will create an invigorating atmosphere that befits a Zen zone. Declutter Radically Stellar nightlife is a big part of why so many people decide to move and work in big cities. However, this also means that their bathroom is usually cluttered with accessories, makeup material, perfumes, and other toiletries. This is simply inexcusable for a legitimate spa zone! So, you need to get rid of all the items that you do not use daily and place them in convenient storage – either in a cabinet outside the bathroom or in a medicine cabinet. If you can, dedicate an entire cabinet or a basket to spa items exclusively. All The Right Colors Thankfully, darker bathroom tones are going out of Vogue this year which is an impeccable timing if you want to turn your lavatory into a spa space. Calming tones and bright primary color are the way to go. As a matter of fact, simple white tiling is the best neutral option for spa background. Shades of beige, organic sandstone appeal and stained wood can offer interesting variations to break up the overwhelmingly white and they make a fine aesthetic choice. The budget for luxury If your financial backing is good and you are of the opinion that one should spare no expense when it comes to creating a domestic spa area, install a dedicated spa tub and separate it from the “utilitarian” washing space. If you have an ample square footage in your bathroom and you want to take it up a notch, do thorough research in order to discover what makes, for example, the finest swim spas in Sydney. With such an element added to your bathroom, you can practically open a professional spa in your home. See to it that your spa tub is separated from the rest of the bathroom space visually – either make structural adjustments or at least install a divider or a curtain. If your financial options are limited… Of course, if you have a frugal budget, you can still create a nice spa space. Who says that Zen bathroom must come at a deluxe price? You just need to adopt the right mindset and do some small changes that go a long way. For example, changing the visual style, decluttering and adding houseplants are all manageable options in economic terms. You can invest in meaningful tweaks such as shower-head upgrade. You can easily find the ones that come with a message mode and a selection of other choices. Multiple settings combined with several shower-head holders for convenient height will do the trick. You can have a relaxing waterfall shower after a short session of high-pressure water-flow massage, and you don’t have to spend a fortune in order to enjoy this. A spa is also about scents Aromatherapy is an integral part of spa treatments. After a long day at work, you can simply relax in your bathtub as the scents of minty plant and essential oils caress your nostrils. They will soothe your body and spirit and acquiring them is a non-issue. For the final touches to your spa bathroom, venture out to shop the most invigorating scents and lotions. Scented candles are also a must for your domestic spa. They are a good interior-design hack that will enhance the effect you want to achieve without too much effort. Create Mood Lighting Of course, scented candles can also provide amazing mood lighting befit of the most luxurious spa spaces, but they will not be enough. You will want to achieve a soft glow to each of the light sources in your bathroom, so you can at least purchase the right decorative fixtures and glass coverage that will soften the harsh glare. Adding a mirror or two will expand the space visually and reflect more light in the room, rendering it brighter. You can create a Zen retreat in your bathroom by yourself, budgetary constraints or not. The trick is to bring it all down to the core features of what renders certain space a spa-inflected environment, so don’t get hung up on gimmicks and expensive appliances! By following a few simple rules and several smart investments, every day can be the day at the spa. Source: This content is taken from AppraisalNewsCast. It is a famous real estate appraisal blog in USA. The world’s largest mortgage insurer can only check for mortgage defects on a “small” number of mortgages due to technological shortcomings and that’s leading to a potential rise in appraisal-related issues.

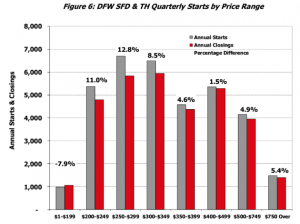

The Federal Housing Administration has already identified issues in appraisals on reverse mortgages and is taking steps to address those issues, but FHA Commissioner Brian Montgomery told the crowd at the Mortgage Bankers Association 2018 Annual Conference in Washington, D.C., on Monday that the FHA is seeing some things in forward appraisals that give him “pause.” The FHA is the “largest mortgage insurer in the world,” Montgomery said, but the agency can’t review all of the mortgages it insures because some of its “key” systems are more than 25 years old. In recent months, the FHA has been looking at “appraisal bias” in its HECM portfolio, recently stating that a review found appraisal issues in 37% of reverse mortgages. But, according to Montgomery, it’s not just the reverse mortgage portfolio that is being affected by appraisal bias. “We are seeing things in the forward book that give us pause,” Montgomery said of FHA forward appraisals. Montgomery also said that FHA is “close” to some policy decisions that could affect appraisals and other parts of FHA lending, but did not provide a specific timeline on when those decisions would be announced or what they would be. Montgomery also discussed the FHA’s role in the administration’s pullback from False Claims Act enforcement, which saw a prodigious rise in the Obama administration. In recent years, many of the nation’s largest banks moved away from FHA lending, with the Department of Justice accusing a number of lenders of violating the False Claims Act by knowingly originating and underwriting mortgages that did not meet FHA standards. Under the Obama administration, lenders of various sizes, including some of the nation’s largest, agreed to pay out billions of dollars in settlements under the guise of the False Claims Act. Those efforts changed the complexion of FHA lending, with depositories like JPMorgan Chase moving away and nonbanks like Quicken Loans filling the gaps. But the Trump administration has signaled a different way of doing things. Montgomery said Monday that the FHA has been directed by the Department of Housing and Urban Development Secretary Ben Carson to work with DOJ on the False Claims Act, and the FHA is doing that. Montgomery said that the FHA is talking with the DOJ, adding that he believes FHA needs to an “active participant” in the enforcement process, cautioning that “there will be no room for bad actors” in FHA lending. Source: Taken from AppraisalNewsCast, which is a real estate news blog. Builders focusing on more affordable housing. If you answered San Francisco, you would have been right, that is, if we were talking about home prices. But we’re not. In terms of new home starts, the Dallas/Ft. Worth area remains the No. 1 market in the country with 35,090 housing starts per year, according to data from Metrostudy, a provider of primary and secondary market information to the housing and related industries. In fact, its housing starts even continue to grow, jumping 12.1% year-over-year in the second quarter, the data showed. And annual closings soared, rising 20.8% annually, the largest increase since the third quarter of 2013. Metrostudy explained this increase in closings follows six months of builders delivering affordable homes in the $200,000 to $300,000 range. The median new home price even dropped in the Dallas-Ft. Worth area by 1.7% from last year to $325,400. Early this year, Freddie Mac predicted new home sales will be the driving factor of housing growth this year as the market struggles to produce enough inventory for the rising demand for homes. And now, that market just got a little more affordable as builders concentrate market growth in the more affordable market segments. The chart below shows what percentage of new home starts are built in each price range. (Source: Metrostudy) The data further enforces the shifting demand for lower-priced homes.

“As builders and developers push to deliver smaller lots and more affordably priced product, expect the median price to fall,” said Paige Shipp, regional director of Metrostudy’s Dallas-Fort Worth market. “In a market where new and resale price appreciation significantly outpaced wage growth, a lower median price indicates that more homebuyers will be able to afford new homes.” “The median resale price of $258,000 is 5.7% higher than 2017,” Shipp said. “As the median new home price drops and resale price increases, the delta between new and resale narrows. Currently, the difference between the median resale and new home price is 26.1%. The greatest difference in price was 50% in 2015.” But this comes at a time when, across the U.S., affordability dropped to a 10-year low due to low mortgage inventory, rising home prices and even Canadian lumber tariffs, according to the latest report from the National Association of Home Builders. Source: This article is based upon the facts published by AppraisalNewsCast, which is an appraisal blog in USA. |

RSS Feed

RSS Feed